The Truth About Down Payments (It’s Not What You Think)

Buying a home is exciting… until you start thinking about the down payment. That’s when the worry can set in.

“I’ll never save enough.”

“I need a small fortune just to get started.”

“I guess I’ll just rent forever.”

Sound familiar? You’re not alone. And you’re definitely not out of luck.

Here’s the thing: a lot of what you’ve heard about down payments just isn’t true. And once you know the facts, you might realize you’re a lot closer to owning a home than you think.

Let’s break it all down and bust some big down payment myths while we’re at it.

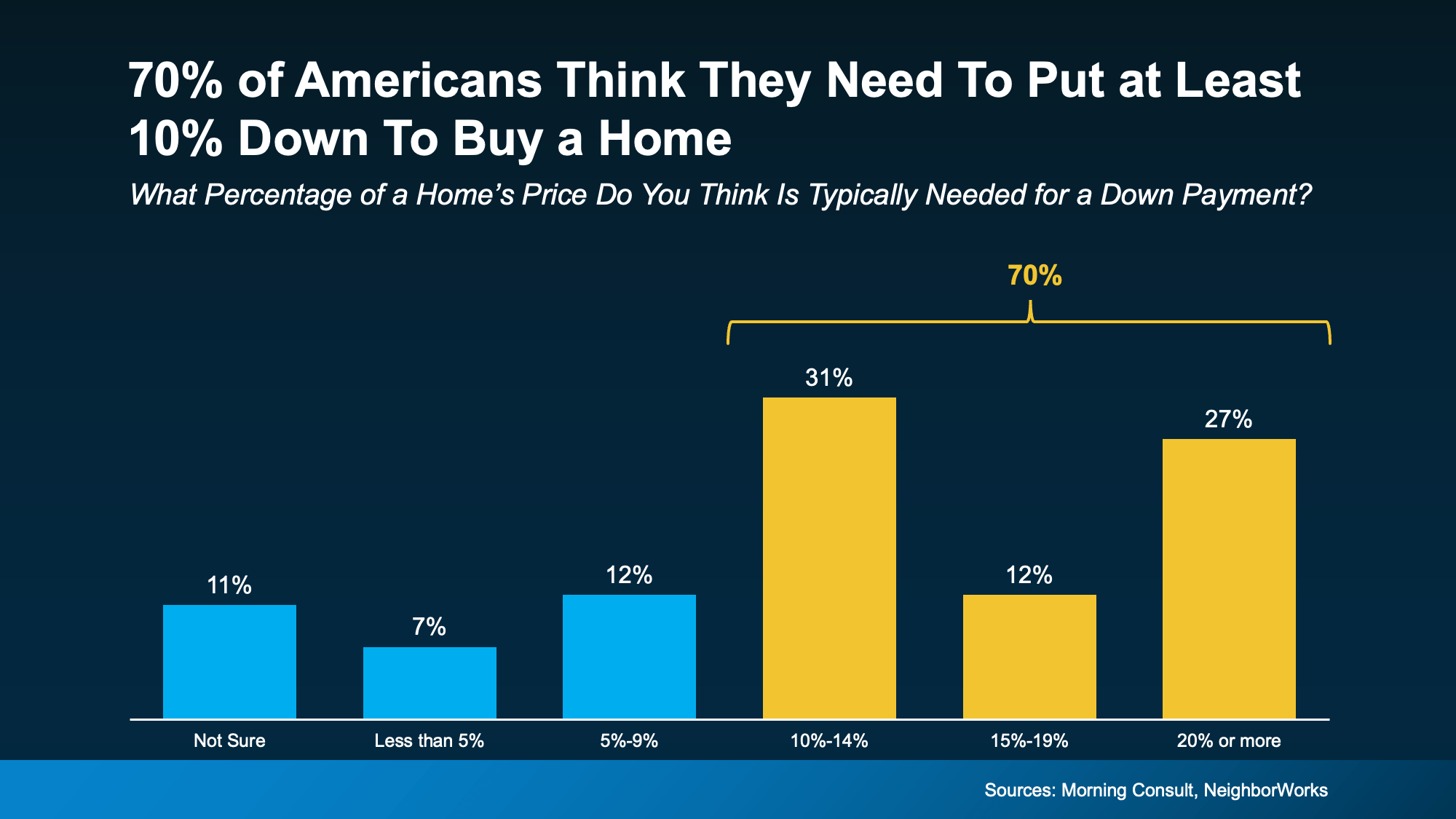

This one stops a lot of people in their tracks. A recent poll from Morning Consult and NeighborWorks shows 70% of Americans think they need to put at least 10% down to buy a home. And 11% aren’t sure what’s required at all (see graph below):

The truth? According to the National Association of Realtors (NAR), the typical down payment for first-time buyers has been between 6% and 9% since 2018. But there’s more to the story. If you qualify for an FHA loan, you may only need to put 3.5% down. And VA loans typically don’t require a down payment at all. So, there are options out there that can really make a difference for some buyers.

The truth? According to the National Association of Realtors (NAR), the typical down payment for first-time buyers has been between 6% and 9% since 2018. But there’s more to the story. If you qualify for an FHA loan, you may only need to put 3.5% down. And VA loans typically don’t require a down payment at all. So, there are options out there that can really make a difference for some buyers.

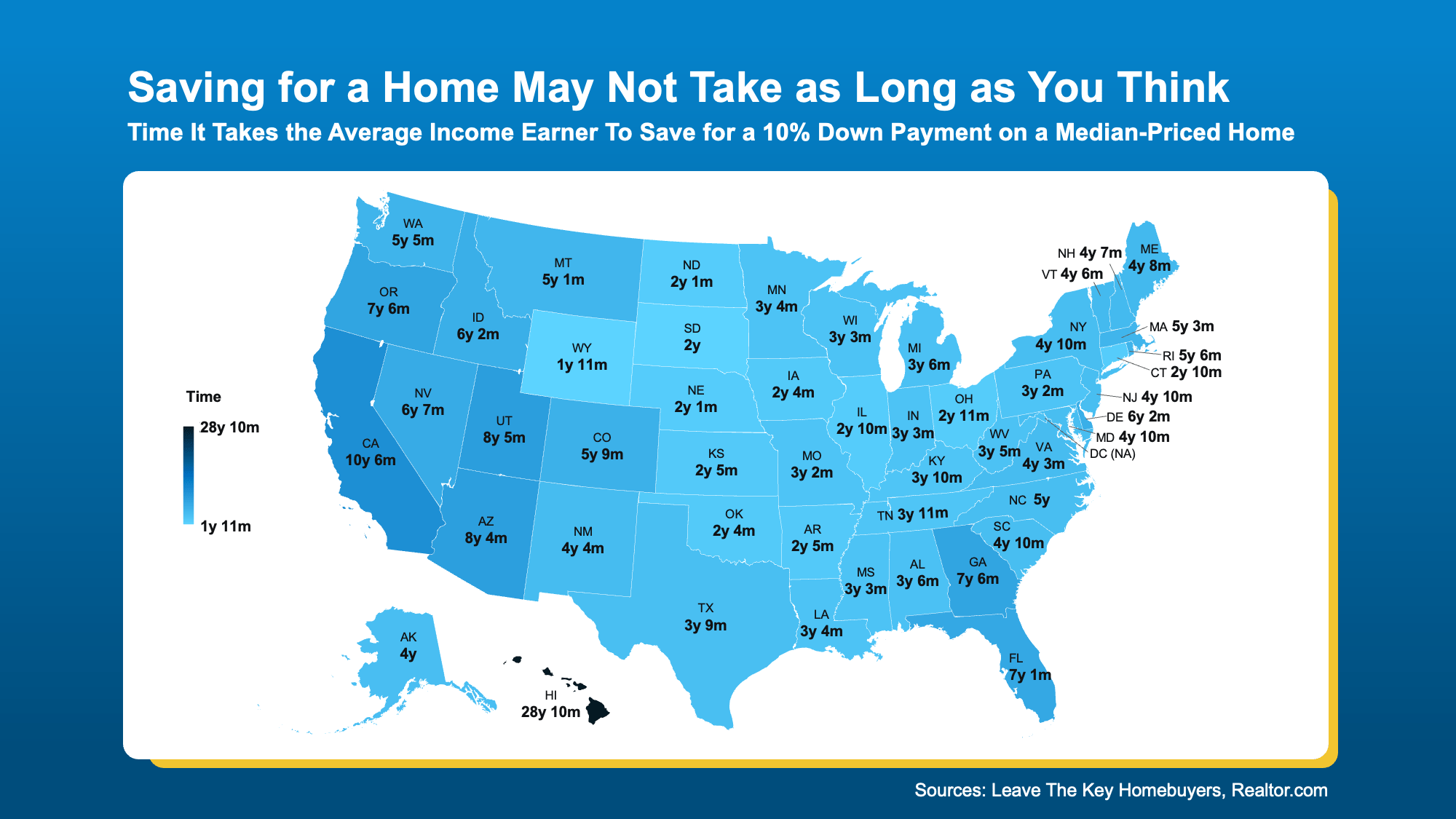

Sure, saving can take time. But it may not have to be as long as you think. In many states, reaching your goal can happen faster than you might expect, especially when you know your budget and have a clear savings plan.

According to a new study, the amount of time varies depending on where you live. The map below shows, on average, how many years it takes to save up for a 10% down payment based on typical home values and income levels in each state (see map below):

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.

This is one of the biggest myths of all. The reality is, there are thousands of down payment assistance programs out there, and the same poll from Morning Consult and NeighborWorks shows 39% of people don’t even know about them. That means a lot of potential homebuyers could already be closer to homeownership – they just don’t realize it.

These assistance programs are designed to help people like you who are ready to own a home but just need a little support getting started. As Miki Adams, President at CBC Mortgage Agency, explains:

“With high interest rates and soaring home prices, down payment assistance is more essential than ever.”

If you’ve been putting off buying a home because the down payment feels like too much to tackle, let’s talk. You may not need as much as you think, and there are plenty of resources out there, so you don’t have to do it alone. You just need an expert to point you in the right direction.

If a down payment wasn’t holding you back, would you be ready to start your home search?

Stay up to date on the latest real estate trends.

Real Estate

August 10, 2025

Enhance Your Geneva Lake Home with These Essential Smart Technologies

Bob Webster | August 8, 2025

August 6, 2025

August 4, 2025

Bob Webster | August 1, 2025

July 30, 2025

July 28, 2025

July 25, 2025

July 23, 2025

Bob is dedicated to offering the finest real estate service available in the Lake Geneva area. He attempts to make each buyer or seller he works with feel like they are the one and only client he has and strives to make each transaction a pleasurable experience with the least amount of problems, stress, and inconvenience to them.